How We Bring Value

RESIGHT Investors acquires, remediates and repositions distressed and impaired real estate in primary markets throughout the U.S. We are unique in our ability to combine significant capital resources with our in-house, regulatory and technical know-how, risk management, land planning and development expertise to rehabilitate unproductive real estate assets and underperforming balance sheets.

We have the ability to close transactions on an all-cash basis and we have a proven track record of achieving environmental site closures in support of the highest and best reuse for industrial sites, institutional assets and former brownfield sites across the country.

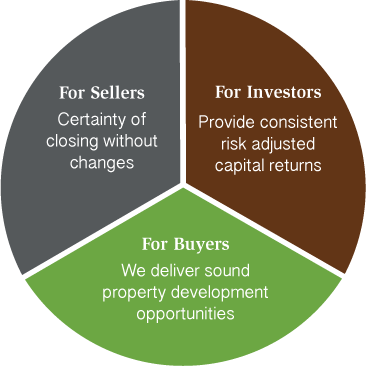

RESIGHT Investors collaborates with real estate sellers, investors, and buyers to maximize risk-adjusted returns on investment, increased diversity in investment options, maximize liability resolution, and ensure high-integrity transaction management.

Our integrated disciplines allow us to consistently secure opportunities that most competitors ignore due to perceived transactional risk and ill-defined cost factors. RESIGHT Investors is committed to the idea of thoughtfully deploying capital to create real value.

THE RESIGHT Investors approach to investment includes:

Well-Defined Investment Criteria: RESIGHT Investors identifies and acquires assets with strong real estate fundamentals that are undervalued due to factors including market illiquidity, excess leverage, environmental impairment, entitlement impairment, bankruptcy, neglected ownership, and more.

Comprehensive Due Diligence: We perform comprehensive due diligence on every transaction to ensure that we clearly understand all aspects of the real estate asset involved, including any necessary development needs and the structure of the transaction itself. This provides the data for informed decision-making during property negotiations.

High-Integrity Transactions: With our comprehensive and data-driven approach, RESIGHT Investors brings value to all parties by facilitating a high-integrity, accelerated closing process with minimized risk of transaction abandonment.

Comprehensive Redevelopment Strategies: Once an asset is purchased, RESIGHT Investors adeptly executes redevelopment strategies that maximize the market value of the purchased property. These efforts often include demolition and renovation, environmental remediation, redevelopment, rezoning and more.

Exit Strategies: With the real estate property repositioned, RESIGHT Investors manages the marketing and sale of the property in order to accelerate a high-integrity transaction.